Landlords face problems with higher interest rates and more bills.

To handle these challenges well, they need to take smart actions. Let’s look at two things they can do to stay ahead.

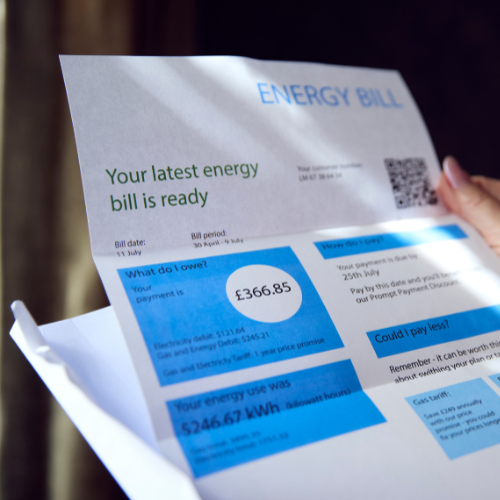

As a landlord, a good way to protect against higher energy bills is by putting a limit. When you make a rental agreement, think about setting the highest amount the landlord will pay for energy bills. This helps to plan the budget, and if the costs go over the limit, the tenant pays for it. By managing energy costs, landlords can keep their money stable even when utility prices go up.

Usually, rental agreements had a rule where the rent goes up by a set percentage. But in today’s market, this way might make landlords face unexpected problems. A better plan is to leave the rent increase part empty, so you can change it as necessary. This flexibility helps landlords deal with economic changes, like higher interest rates, without being stuck with old rules about percentages.

These strategic moves helps landlords to navigate uncertainties with confidence, ensuring they not only protect their investments but also thrive in today’s competitive environment.

Safeguard your property investments. Our expert team can help you implement strategic measures to protect your investments and thrive in today’s competitive rental market. Fill out the form below!